Bridging the Gap Between Decentralized and Centralized Exchanges & Streamlining Digital Asset Trading with AI-Powered Solutions

Read More

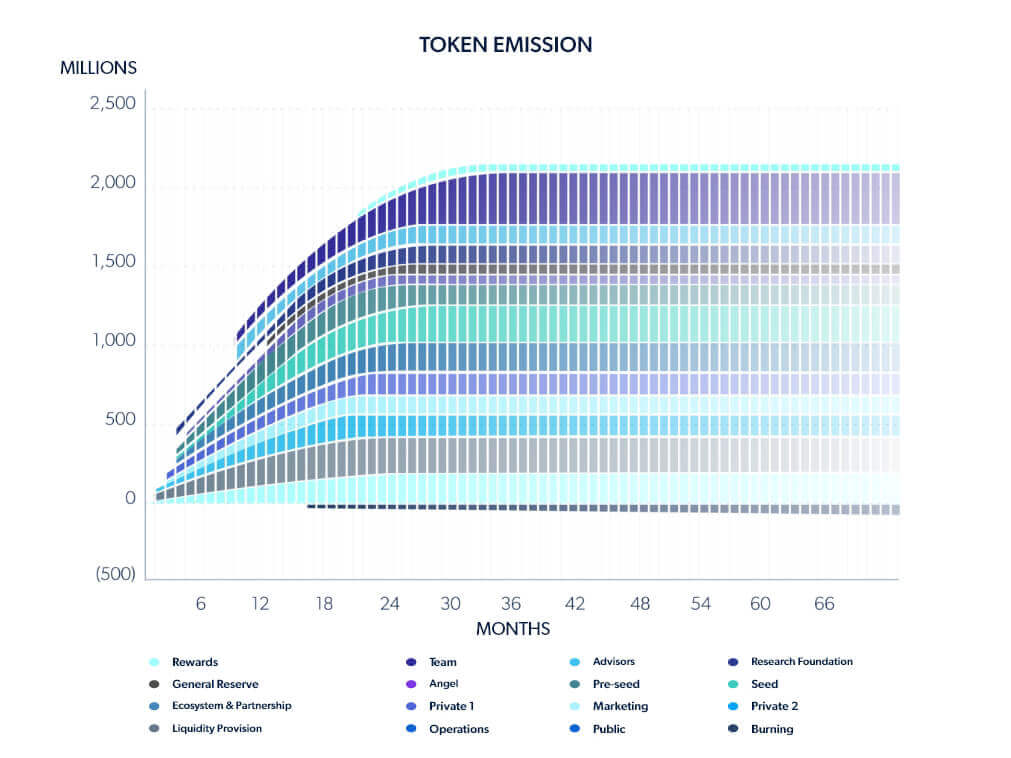

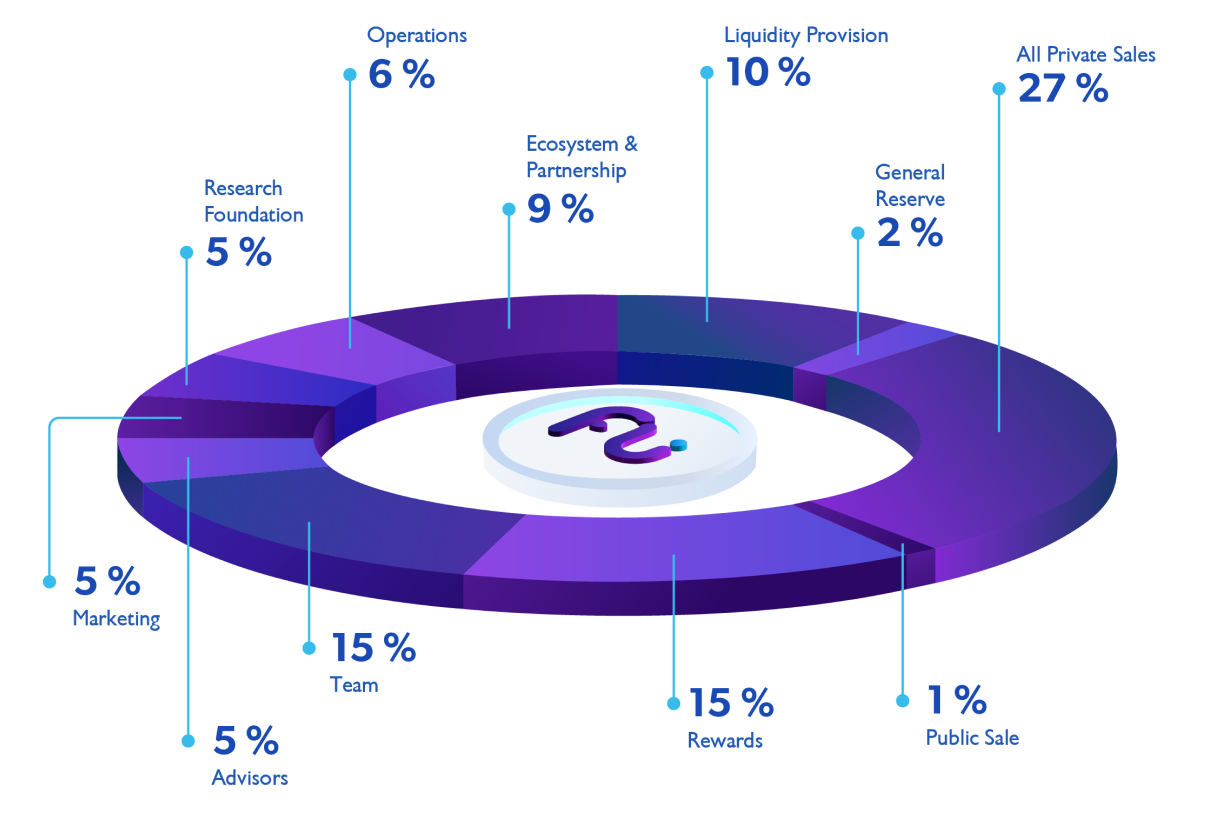

FluidAI’s Tokenomy

FluidAI’s token allocations and vesting schedules have been carefully designed in the interest of various retail and institutional stakeholders

Crypto Exchanges Globally

500+

24H Global Trading Volume

$91.55 B

Market Opportunity

$2.50 T

Best Offer ETH

$2,994.18

Best Offer BTC

$61,510.30

Best Offer YFI

$6,660.00

Best Offer DOT

$6.61

Tokens are sold to strategic partners to fund a solid runway for the company, without selling too large of a share, so as to allow for a larger reserve for contingencies.

This goal is further supported by applying longer vesting schedules to all sales (including the public round), and only the public round being granted a limited 10% release of their allocation at TGE. This structure ensures that FluidAI only receives capital from strategic partners who are willing to go the distance to work with us and support the project.

The chosen vesting schedules also commit FluidAI’s team to a long-term vision. Allocations funding internal departmental budgets have been given vesting terms that last 4 to 5 years.

2.7B Tokens to be Distributed

Token Allocation

Token Vesting Schedule & Metrics Design

-

AllocationVesting ScheduleMonthly Vesting

-

Angel (3.2%)Vests daily over 48 months, beginning day 361 after listing2.0%

-

Pre-seed (5.3%)Vests daily over 18 months, beginning day 91 after listing5.5%

-

Seed (9.5%)Vests daily over 18 months, beginning day 61 after listing5.5%

-

Private 1 (6.4%)Vests daily over 18 months, beginning day 31 after listing5.5%

-

Private 2 (3.2%)Vests daily over 16 months, beginning day 31 after listing6.0%

-

Public (1.1%)10% unlocked at listing. 90% vests daily over 6 months beginning day 1 after listing15.0%

-

Rewards (15%)Emissions dependent on staking APYs and community uptake

-

Team (15%)Vests daily over 48 months, beginning day 181 after listing2.0%

-

Advisors (5%)Vests daily over 36 months, beginning day 181 after listing3.0%

-

Marketing (5%)Vests daily over 60 months, beginning day 31 after listing1.6%

-

Research foundation (5%)Vests daily over 60 months, beginning day 181 after listing1.6%

-

Operations (6%)Vests daily over 24 months, beginning day 1 after listing4.0%

-

Ecosystem & Partnerships (9%)Vests daily over 60 months, beginning day 31 after listing1.6%

-

Liquidity provision (10%)25% unlocked at listing, 75% vests daily over 35 months beginning day 1 after listing2.0%

-

General reserve (1.6%)Vests daily over 60 months, beginning day 181 after listing1.6%

Latest News

For company updates, please follow us on our socials. For enquiries, press, and job opportunities, please use the contact form.

How to Participate and Maximize Your $FLD Rewards

Read more