How FluidAI Aggregates DEXs and CEXs

Bridging the Gap Between Decentralized and Centralized Exchanges & Streamlining Digital Asset Trading with AI-Powered Solutions

How FluidAI Aggregates DEXs and CEXs

FluidAI is a novel platform that leverages cutting-edge artificial intelligence to revolutionize how traders interact with DEXes, CEXes, and liquidity pools.

This article explores the innovative approach FluidAI takes in aggregating these diverse sources of liquidity, offering unparalleled benefits to both retail and institutional traders, and why you should be using FluidAI as your main liquidity aggregation solution.

Contents

🌐 The Challenge of Fragmented Liquidity

🤖🌊 FluidAI’s Vision: AI-Powered Liquidity Transformation

⚙️ Key Components of FluidAI’s Aggregation System

👥 Benefits for Traders

💻 User Experience and Features

💸 Token Utility and Ecosystem

🔮 Future Developments

🌐 The Challenge of Fragmented Liquidity

Before we explore FluidAI’s solution, it’s crucial to understand the problem it addresses. The cryptocurrency market, despite its meteoric rise to a multi-trillion dollar valuation, suffers from a fundamental issue: liquidity fragmentation — Which is when liquidity becomes dispersed across multiple blockchains, exchanges and various liquidity pools. Unlike traditional financial markets with sophisticated liquidity infrastructures, the crypto ecosystem is plagued by:

- Lack of price discovery and best execution

- Vulnerability to market manipulation

- Thin trading volumes across many trading pairs

- Significant price disparities between venues

- Lack of regulatory frameworks for institutional participation

- Major counterparty risks

- Wide spreads

- High latency trades

These challenges result in inefficiencies that can lead to suboptimal trading experiences, increased costs, and potential losses for traders of all sizes.

🤖🌊 FluidAI’s Vision: AI-Powered Liquidity Transformation

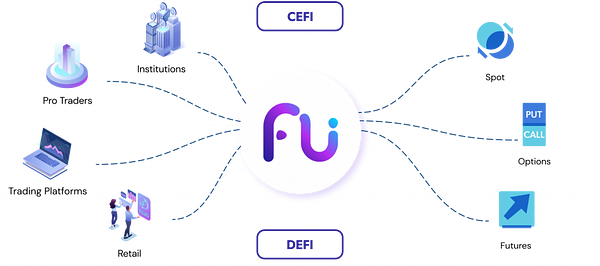

FluidAI’s vision is to leverage AI to create efficient tokenized market access. By integrating with centralized finance and decentralized finance infrastructures, FluidAI serves a variety of users including institutions, trading platforms, and retail and professional traders. FluidAI’s advanced liquidity aggregation tools support a range of trading actions such as spot trading, options trading, futures trading, and more.

FluidAI connects various financial systems that ensure users benefit from the most advanced liquidity aggregation tools available on the market.

⚙️ Key Components of FluidAI’s Aggregation System

- Event-Driven Architecture

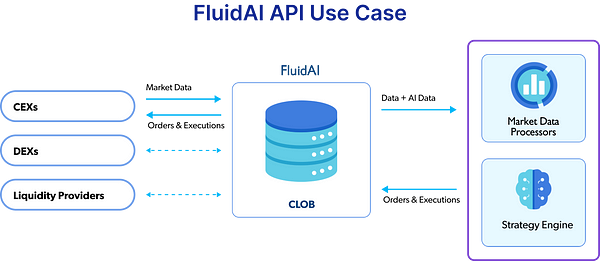

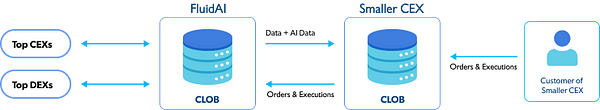

At the heart of FluidAI’s system is a sophisticated event-driven architecture. This design allows for real-time processing of market data, orders, prices, and user information across multiple exchanges and liquidity pools. The Event Bus serves as the central nervous system, ensuring that all components of the system can react swiftly to changes in market conditions. - Centralized Limit Order Book (CLOB)

FluidAI’s CLOB is a game-changer in the world of crypto trading. It consolidates order books from both centralized and decentralized exchanges, creating a comprehensive view of the market. This includes synthetic order books generated from Automated Market Maker and Orderbook DEXs, providing traders with unprecedented visibility into available liquidity across the entire ecosystem. - Smart Order Router (SOR)

The SOR is the brain behind FluidAI’s execution strategy. When a user places an order, the SOR considers multiple factors:

– Liquidity available on various CEXs and DEXs

– Latency to different exchanges

– Execution costs

– Liquidity from market makers

– Potential for internal order matching

– AI-predicted prices, volume, liquidity, and volatility

– Based on these factors, the SOR determines the optimal way to slice and route orders, ensuring best execution for the trader. - Execution Algorithms

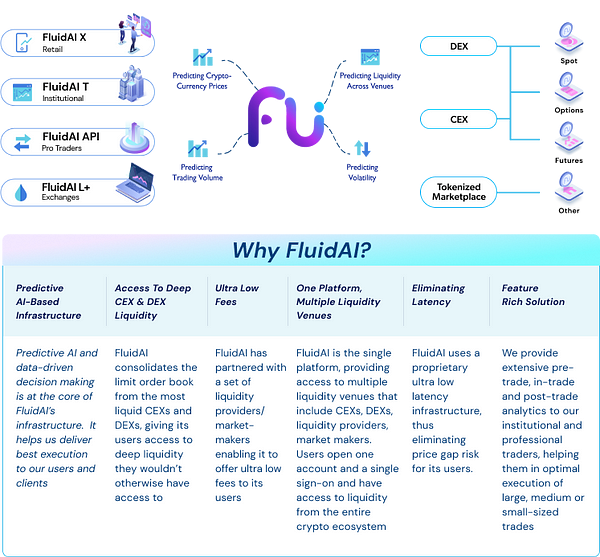

FluidAI leverages its core AI prediction models to provide a set of execution algorithms that include Volume Weighted Average Price (VWAP), Time Weighted Average Price (TWAP), Volume Participation, and Implementation Shortfall. The algorithms allow a large institutional order to trade during the course of a day (or multiple days), and minimize slippage and reduce market impact. - AI-Powered Prediction Models

FluidAI’s true competitive edge lies in its advanced AI models. The platform employs a hybrid cryptocurrency prediction model that combines deep learning techniques such as Recurrent Neural Networks and Support Vector Machines. This allows FluidAI to predict prices, trading volume, cross-venue liquidity, and volatility with high accuracy for up to two minutes into the future. - Exchange Gateways

To interface with the diverse landscape of exchanges, FluidAI utilizes Exchange Gateways. These gateways manage the communication between FluidAI’s core systems and the various CEXs and DEXs, ensuring seamless integration and execution across multiple platforms.

👥 Benefits for Traders

FluidAI’s aggregation approach offers numerous advantages to its users:

- Best Execution

By leveraging AI predictions and a comprehensive view of the market, FluidAI can offer traders the best possible execution prices. - Reduced Slippage

The ability to access deep liquidity across multiple venues minimizes the impact of large trades on market prices. - Lower Fees

Through strategic routing and internal matching, FluidAI can often reduce the overall fees paid by traders. - Enhanced Market Insights

Users gain access to FluidAI’s proprietary AI-based price and volume predictions, providing a significant edge in trading decisions. - Simplified Trading Experience

Instead of managing multiple exchange accounts, users can access the entire crypto ecosystem through a single interface. - One-Time KYC

A significant benefit for users is that they only need to perform KYC once on the FluidAI platform. This single KYC process grants access to all centralized exchanges connected to FluidAI, saving time and effort. - Institutional-Grade Security

FluidAI implements robust security measures, including Zero Trust Security Architecture, multi-factor authentication, and advanced encryption protocols.

💻 User Experience and Features

FluidAI doesn’t just stop at aggregation; it offers a suite of features designed to enhance the trading experience:

FluidAI X: A retail trading platform that includes

- AI-based price predictions

- Consolidated order books

- Advanced order types

- Smart Order Routing

- Real-time order monitoring

FluidAI T: An institutional-grade platform offering

- Pre-trade and in-trade analytics

- Advanced charting with TradingView integration

- Execution algorithms (VWAP, TWAP)

- Portfolio management tools

FluidAI API

- Allows advanced traders to build custom strategies and access FluidAI’s infrastructure programmatically.

FluidAI L+

- Seamless integration and execution of trades at top CEXs and DEXs

- Ability to stream order book data from top centralized and decentralized exchanges

- Access to FluidAI’s proprietary price prediction data layered on top of order book data

💸 Token Utility and Ecosystem

The $FLD token plays a crucial role in the FluidAI ecosystem. By staking tokens, users can unlock various benefits:

- Discounted trading fees

- Farming/staking options

- Access to more advanced AI prediction data

- Participation in the AI-driven DAO for governance decisions

- Rewards through a carefully designed distribution system

⭐ Read about the $FLD airdrop and how you can maximize your rewards HERE

🔮 Future Developments

FluidAI’s vision extends beyond the current cryptocurrency markets. The platform aims to expand its aggregation capabilities to include:

- NFT marketplaces

- Tokenized real estate

- Securitized products and other alternative assets

This expansion will position FluidAI as a comprehensive liquidity hub for all types of digital assets.

Looking ahead

Get ready for an exciting future with FluidAI! By the end of July, we will be launching centralized exchange aggregation paired with cutting-edge AI to maximize the capital efficiency of swaps. Looking ahead to the end of August, our AI integration will extend to decentralized exchange aggregation. This means that FluidAI will offer both centralized and decentralized exchange aggregation, enhanced with advanced AI technology!

Stay tuned and join us on this groundbreaking journey to revolutionize digital asset trading. The future of trading is here, and it’s brighter than ever with FluidAI!

About the Author

Kiran Pingali is the CEO of FluidAI. He has over 25 years of experience building and managing electronic & algorithmic trading, liquidity aggregation, and trading analytics platforms that generated in excess of $100M ARR for firms such as Citigroup, Lehman Brothers, Refinitiv, and Bloomberg. Kiran holds a Masters in Engineering (Computer Science) from Cornell University, and an MBA (Finance, Strategy) from Columbia University. He is also a CFA charterholder.

About FluidAI

FluidAI is a liquidity aggregator that leverages advanced AI technology to provide efficient access to digital asset markets. By addressing issues like liquidity fragmentation and high volatility, FluidAI offers deep liquidity and best execution for both retail and institutional traders. Beyond aggregation, the FluidAI platform enhances the crypto ecosystem with innovative tools and solutions that promote precise trading, advanced security, and intelligent market analysis in digital asset trading.