Harnessing AI To Make Tokenized Market Access More Efficient For All

Harnessing AI To Make Tokenized Market Access More Efficient For All

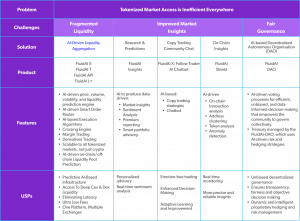

FluidAI makes tokenized market access more efficient for institutions, trading platforms, and retail investors by using predictive AI-based models to solve inefficiencies in digital asset markets. This objective is achieved through the utilization of cutting-edge artificial intelligence (AI) technology.

Unlike the equities, FX, or commodities markets, which have sophisticated liquidity infrastructures and settlement systems, crypto markets suffer from several problems arising from a lack of liquidity such as high volatility, large price slippages, vulnerability to market manipulation, and flash crashes.

FluidAI has developed and applied a transformational proprietary predictive AI infrastructure within its flagship liquidity aggregation solution in addition to developing a suite of innovative applications and tools that help end users access tokenized markets more efficiently. FluidAI’s suite of solutions solves an array of challenges in the crypto ecosystem and includes:

FluidAI’s Vision, Mission & Values

Why FluidAI’s Vision is AI

Despite the boom of decentralized finance (DeFi) and cryptocurrencies, the trading and liquidity infrastructure for virtual assets is still in its relative infancy. As a result, digital asset markets are highly inefficient, caused by challenges such as liquidity fragmentation.

Since its founding, FluidAI’s vision has been to unlock the unlimited potential of AI as a tool and transform the efficiency of crypto markets by incorporating it at the heart of its infrastructure and ecosystem. As virtual asset markets develop beyond cryptocurrencies into new realms and tokenized asset classes such as NFTs, equities, and real estate, FluidAI’s infrastructure is effectively scalable to be applied to any public or private digital asset trading venue.

FluidAI’s technological approach utilizes both traditional and emerging AI technologies, including Machine Learning (ML), natural language processing, computer vision, deep learning, robotics, expert systems, reinforcement learning, generative models, and edge computing.

When utilized appropriately, these technologies have the potential to substantially improve the quality of prediction engines and enhance user experience, ultimately contributing to the goal of creating efficient access to tokenized markets for all.

Liquidity fragmentation is the primary cause of extreme volatility and market manipulation practices within the crypto markets and remains a key limiting factor to mainstream trust, acceptance, and adoption of virtual assets.

Despite the significant growth of the digital assets industry into a multi-trillion dollar market, exchanges and institutions still struggle with the challenge of sourcing liquidity across various blockchains in an efficient, compliant, and transparent manner.

Tokenized markets currently lack viable, scalable, and effective solutions. Traditional methods and solutions, which work for low-volatility markets such as FX, commodities, or blue-chip equities, are inadequate for the highly volatile crypto markets. Even large multi-billion dollar exchanges and institutions struggle to find efficient, fast, and cost-effective liquidity providers with low counterparty risk.

Unlike the equities, FX, or commodities markets, which have sophisticated liquidity infrastructures and settlement systems, crypto markets suffer from several problems arising from a lack of liquidity such as high volatility, large price slippages, vulnerability to market manipulation, and flash crashes. To put this in detail:

- Lack of Price Discovery and Best Execution: Cryptocurrency exchanges may have varying order prices due to the lack of regulatory standards in the industry. This means that exchanges are not required to conform to Best Execution practices.

- Market Manipulation: Exchanges work in silos, and users have more control over stock fluctuations by creating cells to pump and dump. An individual or trading entity can also manipulate the market by creating fake orders to manipulate the price; these strategies have been deemed non-compliant in traditional trading and have consequences if practiced.

- Thin Volume Across Trading Pairs: There are over 500+ centralized exchanges and decentralized swapping platforms where only a handful (mostly centralized) holds the majority of liquidity. This leaves many smaller exchanges trading the same assets but with very low volumes, making them inefficient to trade on. Shadow volumes and order books created by exchanges to attract new users also pose a real problem where liquidity is double counted to show artificially inflated volumes.

- Price Disparity Between Venues: The price of a single token can drastically differ from one exchange to another. The disparity between exchanges is due to fragmentation caused by an inefficient ecosystem.

- Lack of Regulatory Framework for Institutional Participation: There are no clear rules or guidelines for institutions to participate in digital asset markets. A lack of regulatory frameworks creates uncertainty and hesitation amongst institutional investors that are hesitant to enter a market without established regulatory guidance.

- Major Counterparty Risks: The risk of default from one party arises when either party fails to honor its obligations. It can happen in the absence of proper onboarding due diligence, and also due to fraud, or hacks.

- Wide Spreads: The greater the disparity between the bid and ask price, the more costly it is to buy or sell an asset.

- High Latency Trades: High latency infrastructure can result in several problems in trading such as slow execution, reduced profitability, limited scalability, and decreased competitiveness.

Creating a frictionless solution that replicates institutional-level liquidity aggregation seen in the global FX and equities markets is needed in digital asset markets.

To address this issue of fragmented liquidity, FluidAI is employing artificial intelligence to achieve Best Execution.

What is Best Execution?

For more information: https://www.investopedia.com/terms/b/bestexecution.asp

FluidAI uses best-in-class ultra-low latency technology and extensive use of predictive and sophisticated AI models to achieve Best Execution.

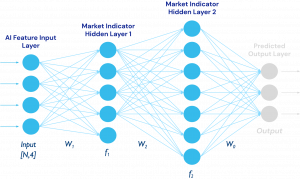

Research studies have indicated that statistical quant models work but are limited in predictive accuracy due to their linear nature and inability to comprehend various variables of mass data. By utilizing machine learning and deep learning, FluidAI is able to comprehend a whole multitude of macro and micro economic variables and sentiment features that are needed to predict the price of an aggregated order book more precisely.

FluidAI has developed a hybrid cryptocurrency prediction model which is proprietary and patent pending. It is able to determine how cryptocurrencies trade on exchanges and predicts prices, volume, volatility, and liquidity up to two mins into the future with high accuracy. It combines various powerful methods from Deep Learning such as Recurrent Neural Networks (RNN) and Support Vector Machines (SVM).

Cryptocurrency markets possess complex characteristics because there are numerous interacting elements in the markets and many nonlinear features. This complexity is due to the vast volatility and a large number of data points, making it a challenge when using traditional methods to conduct prediction. FluidAI seeks to improve the prediction of cryptocurrency order book prices in a time series with its nonlinear nature and complexity by introducing Machine Learning, a subset of AI. ML alone is not the solution; rather, it expands the analytical toolkit as it extends or evolves from current quantitative methods.

Deep Learning, which is a subset of ML, is based on special artificial networks that allow us to solve the problem of prediction and classification by utilizing learning sequences in the data. In addition to being more flexible than traditional methods, it can also reveal hidden structures in complex, large data sets by exposing relationships and interactions between predictive variables.

FluidAI’s aggregated order book technology addresses latency and market inefficiencies by using proprietary AI-based predictive models used comprehensively throughout its infrastructure.

FluidAI’s core engine is an AI-based prediction model and Smart Order Router across CEXs and DEXs, providing Best Execution and powering FluidAI’s key products:

- FluidAI X: A retail trading platform with token utility

- FluidAI T: An institutional platform introducing deep liquidity for large notional trading

- FluidAI API Trading: Automated trading techniques

- FluidAI L+: For exchanges that require additional liquidity to provide a better user experience

FluidAI X

FluidAI X is a seamless trading and swapping solution for retail and professional traders. It offers both a web-based and mobile application. Users have access to the entire crypto ecosystem through one interface and can trade a set of centralized exchanges (CEXs), or swap tokens at a set of decentralized exchanges (DEXs). Key features of FluidAI X include:

- FluidAI’s proprietary AI-based price prediction model

- A consolidated order book across centralized and decentralized exchanges, giving users a comprehensive view of the crypto market

- An order ticket that includes Limit, Market, and Stop Limit orders

- A Smart Order Router that optimizes routing based on price and liquidity and provides Best Execution

- An Order Blotter, giving users full control over their orders. It includes real-time order monitoring, as well as the ability to cancel and/or replace orders

- Staking: Users can stake the $FLD token to unlock key discounts and features on the platform

- Wallet: Users can seamlessly connect their external third-party wallet to trade at a set of decentralized exchanges, or create a FluidAI wallet to trade at a set of centralized exchanges

FluidAI T

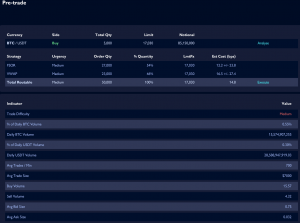

FluidAI T (‘T’ for Terminal) is a web-based order and execution management system (OEMS) for institutional and advanced professional traders. It is used to make large trades and execute advanced trading strategies. It offers a set of pre-trade and in-trade analytics, helping users achieve Best Execution on user trades. Key features of FluidAI T include:

- Pre-trade and in-trade analytics providing advanced color on trades

- Advanced charting that includes integration with Tradingview

- FluidAI’s proprietary AI-based predictive price up to 30 seconds into the future

- A consolidated order book across CEXs and DEXs giving users a comprehensive view of the crypto market

- Advanced trading strategies and execution algorithms that include FSOR, VWAP, TWAP

- Ability to place a trade in the FluidAI Internal Matching Engine (FMATCH)

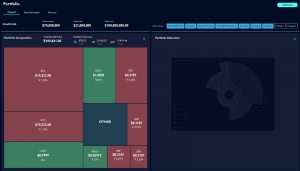

- Advanced portfolio management to analyze portfolio holdings

- Integration with internal middle-office and back-office systems

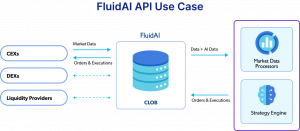

FluidAI API

Institutional and advanced professional traders can build their own proprietary trading strategies and use FluidAI’s API Trading functionality to place their trades. Key features include:

- Access to FluidAI’s real-time consolidated order book data for analysis

- Access to FluidAI’s AI-based price and volume prediction data in real time

- Trade using FluidAI’s ultra-low latency infrastructure and leverage its Smart Order Router and Execution Algorithms

- FluidAI provides both RESTful API as well as websocket interfaces

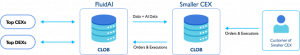

FluidAI L+

Centralized exchanges that lack liquidity can use our consolidated order book and aggregation technology, and provide an enhanced trading experience for their users by integrating FluidAI’s liquidity.

Key features of FluidAI L+ include:

- Seamless integration and execution of trades at top CEXs and DEXs

- Stream order book data from top centralized and decentralized exchanges

- View FluidAI’s proprietary price prediction data layered on top of order book data

FluidAI’s Key Features

FluidAI’s products are powered by several key features, each of which leverages the company’s advanced AI engine, along with predictive models and analytics. These features are designed to forecast market conditions, and include:

FluidAI’s core engine is an AI-based prediction model and Smart Order Router.

FluidAI’s Smart Order Router (FSOR) is its primary back-end engine sourcing liquidity from centralized and decentralized exchanges, and a set of liquidity providers (also known as market makers). The FSOR utilizes FluidAI’s proprietary Consolidated Limit Order Book (CLOB), and FluidAI’s artificial intelligence model and predictive analytics to make optimal execution decisions. It also looks at factors such as latency to venues, cost of execution at these venues, total available liquidity at these venues, and any internal matching opportunities to make routing decisions. Some of the FSOR decisions and features include:

- Market impact-driven routing decisions

- Price/Risk-driven routing decisions

- Liquidity/Opportunistic-driven routing decisions

Execution Algorithms such as VWAP and TWAP

FluidAI leverages its core AI prediction platform to provide the following execution algorithms:

- VWAP: A trading benchmark that represents the average price of a security traded during a certain time period (or throughout the day), based on volume and price

- TWAP: A strategy that breaks up a large order into smaller child orders and is released dynamically to the market using evenly divided time slots during a certain time period

- Volume Participation: A trading strategy that calculates the order quantity as a percentage of the total trade volume of an asset during a certain time period and places an appropriate order

- Arrival Price: Minimizing pre-trade arrival price Transaction Cost Analysis (TCA) and slippage. Post-trade TCA reports will also be provided

Spot and Margin Trading

FluidAI will provide both spot and margin trading across all cryptocurrencies and all major CEXs and DEXs. FluidAI’s platform will provide the necessary infrastructure towards:

- Appropriate risk policies and procedures

- Collateral management

- Optimizing borrowing cost

Futures and Options Trading

FluidAI will provide futures and options trading on all major cryptocurrency pairs to institutional and retail customers. For large crypto derivatives (block trades), customers can utilize FluidAI’s proprietary RFQ-based technology to source deep liquidity. Features include:

- Dynamic delta and volatility trading strategies

- Spread trading and peg-to-parity algorithm

- Ability to trade large blocks anonymously using RFQ technology

Matching Engine

FluidAI’s Matching Engine will provide deep liquidity to its network of institutions and professional traders. FluidAI’s goal is to become ‘the liquidity hub’ across all digital assets. Features include:

- Matching trades internally to provide price improvement over CEXs and DEXs

- Ability to execute large block trades without impacting the price at exchanges

- Anonymity and minimizing market impact

Pre-Trade and In-Trade Analytics

FluidAI’s predictive analytics engine provides the following pre-trade and in-trade analytics, which can be extremely useful when placing large trades:

- Average Bid/Ask spreads

- Buy/Sell Volume

- Trade difficulty

- Market impact (in bps)

- Average Trades/min

- Optimal execution strategies

- Order size with respect to the daily traded volume/value

Post-Trade Transaction Cost Analysis (TCA)

FluidAI provides an extensive set of post-trade Transaction Cost Analysis tools and reports that shed insights into the quality of trade execution. These include:

- Slippage with respect to Arrival Price

- Slippage with respect to Interval VWAP

- Slippage with respect to Interval TWAP

Post-Trade Transaction Cost Analysis (TCA)

FluidAI provides an extensive set of post-trade Transaction Cost Analysis tools and reports that shed insights into the quality of trade execution. These include:

- Slippage with respect to Arrival Price

- Slippage with respect to Interval VWAP

- Slippage with respect to Interval TWAP

Access to Public and Private Tokenized Markets

FluidAI’s roadmap includes liquidity aggregation across all public and private tokenized markets and asset classes such as NFTs, real estate, and securitized products. Features include:

- Ability to trade NFTs through integration with the largest NFT marketplaces

- Ability to trade tokenized real estate

- Ability to trade securitized products, including tokenized shares of private companies

Staking Rewards and Offset Account

FluidAI has introduced a unique AI and gamification system to enhance the user experience while staking the $FLD token. Each user that stakes the $FLD token unlocks key features of the FluidAI platform. This is directly connected to the amount staked versus the tier, which in turn is associated with progressively increasing rewards and benefits. In other words, the more the $FLD users stake and the longer the lock-up period chosen by users, the greater their level, rewards, and benefits. Some of the key benefits include:

- Trading fee discounts

- Ability to view different levels of FluidAI’s proprietary AI price-prediction model

- Ability to follow/copy top traders in the FluidAI network

- Ability to chat with other members of the FluidAI network

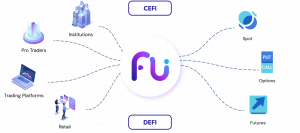

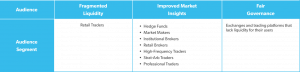

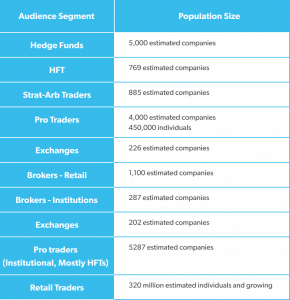

WHO USES FluidAI?

FluidAI’s audience consists of retail users, professional and institutional traders, and trading platforms. In terms of benefits, FluidAI offers multiple advantages to its users:

- For retail, FluidAI provides a user-friendly experience to trade or purchase cryptocurrencies in a seamless and secure manner.

- For institutional and professional traders, FluidAI offers deep liquidity and ultra-low latency with both a manual trading interface and API connectivity.

- There are over 500 exchanges worldwide that are predominantly tier 3 and 4, and are incapable of competing with tier 1 and 2 exchanges, such as Binance and Kraken. FluidAI provides these CEXs and DEXs with access to deep efficient liquidity through FluidAI’s API to offer a better trading experience to users.

FluidAI’s audiences are segmented as follows:

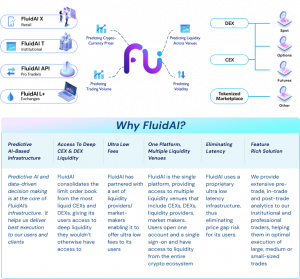

FluidAI is liquidity transformed.

Its key USPs are:

- Predictive AI-Based Infrastructure: Predictive AI and data-driven decision making is at the core of FluidAI’s infrastructure. It helps deliver Best Execution to FluidAI’s users and clients.

- Access to Deep CEX & DEX Liquidity: FluidAI consolidates the limit order book from the most liquid CEXs and DEXs, giving its users access to deep liquidity they wouldn’t otherwise have access to.

- One Platform, Multiple Liquidity Venues: FluidAI is the single window platform that provides access to multiple liquidity venues including CEXs, DEXs, liquidity providers, and market makers. With one account and a single sign-on, users have access to liquidity within the entire crypto ecosystem.

- Eliminating Latency: FluidAI uses its proprietary ultra-low latency infrastructure, eliminating price gap risk for its users.

- Institutional Grade Solutions: FluidAI provides extensive pre-trade, in-trade and post-trade analytics to its institutional and professional traders, helping them in optimal execution of large, medium, or small-sized trades.

- Ultra-Low Fees: FluidAI has partnered with a set of liquidity providers/market-makers enabling it to offer ultra-low fees to its users.

Predictive AI and data-driven decision-making are at the core of FluidAI’s infrastructure. It helps deliver market efficiency to its users and community.

The AI Product Roadmap includes products that will heavily leverage its AI engine and predictive models.

From a token governance standpoint, FluidAI is committed to establishing a decentralized governance model that leverages the power of AI via an AI-DAO to enable efficient and unbiased decision-making. FluidAI’s governance framework ensures transparency, fairness, and community participation in shaping the future of its liquidity aggregation platform.

It is important to note that while AI-powered voting systems offer benefits, they also require careful design, testing, and oversight. Considerations such as transparency, accountability, and auditability should be considered to ensure the integrity and fairness of AI-driven governance and internal liquidity management processes.

As mentioned previously, FluidAI is also developing a whole suite of innovative user-centric applications and tools that help end users access tokenized markets, such as:

On-Chain/Off-Chain Liquidity Pool Prediction

FluidAI is exploring models that involve a quote-driven predictive automated market maker (AMM) platform with on-chain custody and settlement functions, alongside off-chain predictive reinforcement learning capabilities to improve liquidity provision of real-world AMMs. The proposed architecture would involve predictive AMM capability, utilizing a deep hybrid Long Short-Term Memory (LSTM) and Q-learning reinforcement learning framework that looks to improve market efficiency through better forecasts of liquidity concentration ranges. The augmented protocol framework is expected to have practical real-world implications by:

- Reducing divergence loss for liquidity providers

- Reducing slippage for crypto-asset traders

- Improving capital efficiency for the AMM’s liquidity provision protocol

Sentiment Analysis

FluidAI is exploring utilizing its AI models to provide real-time crypto market sentiment analysis for over 200 different currencies. The crypto sentiment data is derived from textual messages across social media platforms such as Twitter, Reddit, and Telegram chat. This simplifies the process for traders which would otherwise require a manual, time-consuming browse of different socials to discover potential affinity towards a particular token. Users are able to view the crypto market sentiment analysis of individual digital currencies based on the distribution of positive/negative/neutral sentiment. Rankings of all the top trending cryptos would be created based on all data gathered by FluidAI’s crypto market sentiment tool.

Copy Trader Bots

FluidAI’s deep learning bots can learn from every closed position and pro trader’s historical data. The model evolves its prediction metrics based on time and data, where the bot picks and ranks successful Pro Traders to provide trade signals. Based on risk management factors like max drawdown, stop-loss, take-profit, etc., the bot distributes a percentage of the capital into a nano fund and diversifies it by opening positions on trade signals sent by chosen Pro Traders. Chosen Pro Traders are rewarded from Copy Trader’s trading fees if they send a winning trade signal. To meet the minimum trade size requirement, various Copy Trader’s nano funds are combined together to act as one position or fund. Profits are then split equally.

AI in On-Chain Data

- On-chain transaction analysis: AI can detect fraud in financial transactions by identifying patterns and anomalies in data. By analyzing transactions on the blockchain, it is possible to identify patterns in buying and selling behavior, which can provide insights into market trends and investor sentiment. Blockchain analysis tools can be used to track the flow of cryptocurrencies between different wallets and exchanges, which can provide insights into demand and how it affects prices.

- Address clustering: By analyzing the flow of cryptocurrencies between different wallet addresses, it is possible to identify clusters of addresses that are controlled by the same entity. This can provide insights into the behavior of large investors and exchanges, which can be useful for predicting market trends and identifying potential risks.

- Token analysis: By analyzing token supply on the blockchain, it is possible to identify the tokens that are most widely held and traded. This can provide insights as to what tokens are most likely to be affected by market trends and those that are most likely to be targeted by hackers or fraud specialists.

- Anomaly detection: AI algorithms can be used to detect unusual patterns or anomalies in the flow of cryptocurrencies on the blockchain. By analyzing the transactional behavior of addresses and wallets, AI can identify suspicious activity such as large transfers or sudden spikes in trading volume.

Market Research and Predictions

FluidAI will use artificial intelligence in market research of cryptocurrencies to help investors make informed decisions and stay ahead of market trends. Some examples are:

- Market research: Financial analysts could use the predictions generated by the AI model to inform their research and analysis of financial markets by identifying trends or anomalies in price movements.

- Data analysis: AI can analyze large amounts of market data, including price trends, trading volumes, and social media sentiment to identify patterns and insights that can inform market research.

- Predictive modeling: AI can use machine learning algorithms to analyze historical data and predict future market trends, such as identifying potential investment opportunities or predicting price movements.

- Sentiment analysis: AI can use natural language processing (NLP) algorithms to analyze social media and other online sources for sentiment analysis, which can provide insights into how people feel about certain cryptocurrencies or the market in general.

- Trading automation: AI can be used to automate trading strategies based on market data, allowing traders to take advantage of market opportunities quickly and efficiently.

- Model portfolios: AI can generate model portfolios to help diversify the risk of investors/traders. These model portfolios can be recommended based on the risk profile of users.

AI Model & Event-Driven Architecture

FluidAI’s Predictive AI Model

FluidAI’s key liquidity aggregation architecture is powered by a proprietary hybrid prediction model which combines various methods from Deep Learning such as Artificial Neural Networks (ANN) and Support Vector Machines (SVM). Supported by linear and nonlinear statistical models amongst other methods, FluidAI’s prediction model allows for highly accurate prediction of price, trading volume, cross-venue liquidity, and volatility for the main cryptocurrency pairs with an exceptionally high level of confidence for up to two minutes into the future.

As cryptocurrency prices are dynamic and highly volatile with large volumes of data, preprocessing and feature selection affect the running of the model when harvesting real-time data.

One of the key features that distinguishes FluidAI’s hybrid cryptocurrency predictive model is the use of Deep Learning, which automates the feature extraction piece of the process, eliminating human intervention while enabling the consumption of large real-time datasets. This can also be viewed as a type of scalable machine learning that classifies and identifies correlations between the datasets to predict prices accurately.

FluidAI’s artificial intelligence model has been developed and results scientifically tested in conjunction with a team of AI experts from the Blekinge Institute of Technology, Karlskrona, Sweden, and Imperial College London.

In the figure below, a description of the architecture is presented which explains the flow and relationships of various activities and modules:

FluidAI: Cryptocurrency Prediction Architecture

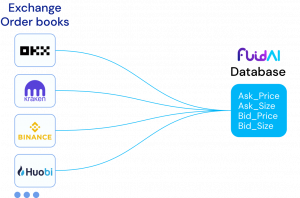

Data is loaded to build FluidAI’s model, and also extracts information from the API dataset as sequenced:

| import plotly.offline as pyo import plotly.graph_objs as go # Set notebook mode to work |

Example:

The model creates the dataset with features and filters the data to the list of features. We then add a prediction column and a set of dummy values to prepare the data for scaling and print the tail of the dataframe for training:

| # Get the number <– > nrows = data_filtered.shape[0] # Convert the data to —–> values np_data_unscaled = np.array(data_filtered) np_data = np.reshape(np_data_unscaled, (nrows, 0)) print(np_data.shape) |

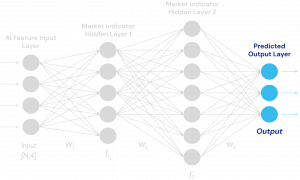

The FluidAI model begins to predict, test and learn the various gates variables of data are routed to. The model then generates a single prediction within milliseconds to identify market fluctuations as identified within the hidden layers:

Training The AI Model

| #Step 4 Model Training |

- Configure the Recurrent Neural Network (RNN) model

- Model with feature variables

- Training the model

- Plot training and validation of loss values

The model is based on a neural network used in AI. Unlike standard feedforward neural networks, the model has feedback connections. This neural network can not only process single data points, but entire sequences of data.

This is now preparing the training to process:

| # Configure the neural network model model = ←—– () |

The model is in its training sequence and starts to test as shown below:

| # Plot training & validation loss values fig, ax = plt.subplots(figsize=(X, X), sharex=111) |

FluidAI’s gate setup and activation function, when trained, is used to generate new results based upon provided past data.

Technical Indicator Generated

The technical indicators are generated and the results show the current model has the ability to forecast prices within a margin of error that reflects actual market conditions in real time:

| # Get the predicted values y_pred_scaled = model.predict(x_test) |

Forecasted Market Price Model with Hidden Error Layers

| df_temp = train_df[-sequence_length:] new_df = df_temp.filter(FEATURES) N = sequence_length (a sequence of prices fed into the model over a period of time) |

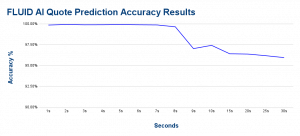

FluidAI’s Prediction Accuracy Results

We measure the accuracy of the model in predicting prices into the future as shown below:

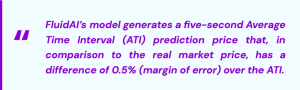

FluidAI’s margin of error is based on the real-time weighted average of the market bid or ask data compared to FluidAI’s predicted bid or ask data.

These predictions are based on an Average Time Interval (ATI), which is a specific time period selected for prediction. For example, FluidAI predicts for 3, 6, or 30-second intervals into the future, known as ATIs.

FluidAI’s margin of error measures the closest proximity of the predicted ask or bid price to the actual ask or bid price within that time interval. For example, if the selected ATI is 30 seconds, then the margin of error is calculated for that thirty-second interval.

In summary, based on the datasets used and the application of neural networks, FluidAI’s machine learning-based model can predict prices with a high level of confidence. Further improvements that are currently being investigated include additional features and investigating elements of sentiment by using text mining and analyses of social networks such as Twitter and other platforms.

FluidAI’s Event-Driven Architecture

FluidAI’s cloud-based event-driven architecture is a complex event processing system. Changes in the environment trigger all data elements in the architecture as a single event on the Bus (displayed as an Event Bus in the Event-Driven Architecture schematic below). To name, a few event message types that transmit through the bus are: market data, orders, prices, accounts, and user data.

An event can be produced or consumed by any of the components that are subscribed to the bus. As an example, the simplest flow would be market data (quote and L2) received by an Exchange Gateway that would generate this event message type. This would ensure the data is highly available and would then be picked up by the AI Engine, DB Writer, and Order Router. If there is a new order, these modules react and process the predicted new quote or order instruction.

The Centralized Limit Order Book (CLOB) module is what holds the consolidated centralized order book across all the CEXs and DEXs. Additionally, the CLOB module creates a synthetic order book from the AMM DEXs, giving it a comprehensive view of all CEXs and DEXs. When a user places an order into the FluidAI ecosystem, the CLOB is updated with FluidAI’s orders, which are off-market.

The CEX and DEX Smart Order Router (SOR) reacts to orders placed via FluidAI by taking a look at factors such as:

- Liquidity on CEXs and DEXs

- Latency to route to these exchanges

- Cost of execution at these exchanges

- Liquidity from market makers

- And any internal orders that can be matched against

The SOR then decides to slice and route to the different market makers and exchanges, creating child order events which the Exchange Gateways pick up off the bus. Executions from the market makers and exchanges then flow back from the Exchange Gateway onto the bus, and into the orderbot and are reflected on the user’s interface.

Illustration above: FluidAI’s Event-Driven Architecture

FluidAI’s Token Utility

The $FLD token is an ERC-20 token that is key to enhancing FluidAI’s ecosystem by connecting users to FluidAI’s utility, which ultimately helps the data-driven nature of FluidAI’s proprietary AI infrastructure through cognitive learning of users’ behaviors.

Additionally, FluidAI has also developed an AI-based gamified approach that aims to incentivize its users and increase the need and want to acquire $FLD. There are currently seven main utilities intended for $FLD under the retail solution, FluidAI X:

- AI-Based Price Predictions: Access to proprietary market prediction data, up to 30 seconds into the future

- Fee Discounts: Discounted fees when users stake

- Community Chat: Speak to traders on the other side of the trade of a specific pair within the FluidAI community

- Referral Rewards: Refer people and get paid commissions in the form of referral fee and percentage of trades (terms and conditions apply)

- Academy: Learn to trade with FluidAI’s beginner to advanced courses

- Follow Trader: Copy top traders within a few clicks

- AI-Based DAO: Community voting on AI projects

By incentivizing users to hold and lock tokens, FluidAI can effectively reduce market volatility of the $FLD token and establish a foundation for long-term growth, creating greater trust and confidence in the crypto ecosystem and economy. FluidAI also offers a range of benefits and rewards as part of its gamification and appreciation strategy, which cultivates a stronger relationship between FluidAI and its ecosystem participants.

Being an AI-first and data-driven solution, a key aspect of FluidAI’s ecosystem is the inclusiveness of its community’s participation to vote on AI projects through its AI-driven Decentralized Autonomous Organization, as mentioned previously, AI-DAO.

Token Governance & FluidAI DAO

FluidAI is committed to establishing a decentralized governance model that leverages the power of AI to enable efficient and unbiased decision-making. The governance framework ensures transparency, fairness, security, and community participation in shaping the future of FluidAI. The AI-based DAO operates based on a predefined governance framework encoded in a smart contract. This framework outlines the decision-making processes, voting mechanisms, and rules for proposing and implementing changes to the AI features.

To ensure objective decision-making, FluidAI incorporates AI algorithms into its voting processes. The AI system analyzes relevant data, evaluates proposals, and provides insights to assist token holders in making informed voting decisions. This AI-based approach minimizes biases and facilitates efficient decision-making by considering a wide range of factors, such as historical data, market trends, and user sentiment. Key features of the voting system include:

- Proposal Submission & Review: All community members are able to contribute to the platform’s development through proposal submissions. The process begins with participants submitting detailed proposals outlining their ideas, rationale, and potential impact on the ecosystem. Proposals undergo thorough review and analysis by autonomous AI screening and designated experts to assess their feasibility, alignment with project goals, and potential benefits.

- AI-Driven Voting and Decision Making: Once proposals pass the review stage, the AI system generates unbiased recommendations to guide token holders during the voting process. Token holders are provided with relevant information and insights from the AI system, empowering them to make well-informed decisions based on comprehensive analysis. During the voting period, token holders can cast their votes through a secure and auditable AI-powered voting mechanism. The AI system considers the voting preferences and weights assigned to each token holder, ensuring that voting power is proportionate to the number of tokens held. The AI algorithms analyze the votes, combining individual opinions to form a collective decision.

- Voting Threshold and Execution: FluidAI employs an adaptive voting threshold that dynamically adjusts based on factors such as the proposal’s significance and potential impact. The AI system assists in determining the appropriate threshold, accounting for the consensus required to implement proposals effectively. Once the voting threshold is reached, the smart contract automatically executes the approved proposal, ensuring its timely implementation.

- Continuous Improvement: FluidAI’s governance model is designed to evolve with the community’s needs and technological advancements. FluidAI is committed to continuously enhancing its AI algorithms, incorporating feedback from participants, and learning from real-world outcomes. Regular audits and transparency measures are implemented to maintain the integrity and effectiveness of the AI-based governance system.

- Transparency and Accountability: The AI-DAO ensures transparency by recording all proposals, votes, and decisions on the blockchain. This transparency helps maintain accountability and allows token holders to monitor the governance process.

By integrating AI-driven voting processes, FluidAI ensures efficient, unbiased, and data-informed decision-making that empowers the community to collectively govern the liquidity aggregator’s future.

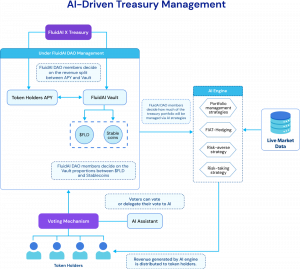

FluidAI DAO Treasury Management

The management of revenue generated by FluidAI X is entrusted to the members of the DAO. The DAO exercises its authority by voting on three key aspects of treasury management:

- Proportion of revenue to be distributed between token holder rewards and FluidAI Treasury Vault

- Asset composition of FluidAI Treasury Vault

- Portion of treasury funds allocated and managed by AI-powered strategies. FluidAI’s engine will actively analyze the market to identify the most optimal asset management strategy

Each DAO member has the option to cast a manual vote or to delegate the voting power to an AI assistant, programmed to select the most optimal decision from a treasury management perspective. The AI assistant will serve as a risk advisor, detecting potential threats that may arise from the implementation of democratic mechanisms.

Using AI To Enhance Token Holder Experience

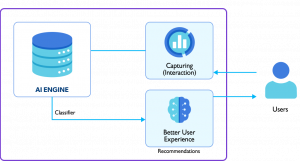

The $FLD is an ERC-20 token that primarily serves as a means of representing and transferring value within the FluidAI ecosystem. ERC-20 tokens themselves do not have inherent capabilities to collect data or improve AI features directly. However, the smart contracts or applications built on top of the ERC-20 token can facilitate data collection and contribute to AI advancements. Here are a few examples of how FluidAI can leverage this data:

- $FLD Usage Tracking: The smart contract governing the token can track how tokens are being used within the FluidAI ecosystem. This data can provide insights into user behavior such as transaction patterns, token flow, and token holders’ activity. Analyzing this data will help improve AI models or algorithms related to user behavior prediction, fraud detection, or market analysis.

- FluidAI Recommends: $FLD token holders will have access to FluidAI’s proprietary AI-based price and volume prediction data, up to 30 seconds into the future. FluidAI will further use machine learning techniques to monitor how users consume this data to make trading decisions and will recommend certain strategies or crypto pairs to these users. The goal is to help these users generate profitable trades using both AI data and the recommended strategies.

- Follow Trader: In this scenario, FluidAI will use AI to monitor the current positions and trading behavior of users and recommend highly successful and profitable traders. Users can choose any trader they’d like based on the user’s staking level unlocked.

- Community Chat: FluidAI will use artificial intelligence in its community chat functionality as follows:

- Similar to the Follow Trader feature, FluidAI will use AI to monitor the strategies and positions of users and recommend certain community chats that they could benefit immensely from.

- An automated chatbot that will provide responses to user queries on key questions related to pricing, volume, and optimal strategies, and provide a daily market-summary report to help users make better investment and trading decisions.

- Portfolio Manager: FluidAI will use its AI capabilities to recommend SMART Model Portfolios to its $FLD token users. These portfolios will be based on the current positions of users and trading strategies. The goal is to help users reduce their risk by diversifying positions and investing in these smart portfolios. FluidAI will also work with index/ETF providers towards offering these AI-generated portfolios to a wider audience.

Overview of FluidAI’s Utility Benefits for Users

An increase in user level unlocks rewards, benefits, and access to premium platform features, which include:

- FluidAI Prediction: FluidAI‘s prediction leverages machine learning and deep learning to provide traders with Best Execution and market prediction data. The tool uses advanced algorithms to analyze market data in real time, enabling traders to make better trading decisions with greater accuracy. To access this feature, a user simply needs to stake and lock at different tiers to access up to 30 seconds of prediction.

- Maker Fee Discount: Maker fees, as opposed to taker fees, are fees that enter the order book and add liquidity to the ecosystem. As a user increases in level based on the amount staked and the lock-up period, their maker fees decrease.

- Follow Trader: A feature that enables users/traders to replicate the trading strategies of other successful traders, allowing them to benefit from the expertise of others within a few clicks. Depending on the tier a user unlocks, it will determine the access they have to traders with a performance of 20% to 100%+ ROI on average.

- Referral Rewards: Each user will receive an opportunity to participate in the referral program and positively contribute to FluidAI’s ecosystem. The minimum reward for a single valid referral is $25 and increases depending on the exact user level which also includes a percentage of the trading fee profit of the referred user (terms and conditions apply).

- Access To Community Chat: At a certain tier, users can unlock access to the dedicated community chat where users trading the same pair can communicate with each other. Feel the excitement, sentiment insights, and hype of being able to trade and discuss with peers in trading.

- Access To FluidAI Academy: This is FluidAI’s CSR initiative and is available to anyone that has staked and locked at the lowest tier, which means they need to stake at least 1500 $FLD for a month to gain full access to the feature. FluidAI is committed to giving back to the trading community and helping hobby traders progress into professional ones.

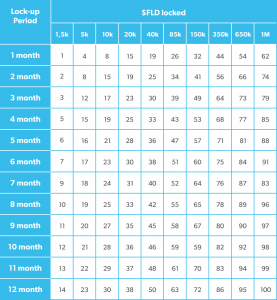

Fusing Gamification to Enhance the $FLD Token Holder Experience

FluidAI is introducing a unique gamification system based on $FLD tokens locked for a period of time. Each user who decides to buy and lock up a certain amount of $FLD for a given amount of time will unlock a user level (from 1 to 100). This is directly connected to the amount staked versus the tier, which in turn is associated with progressively increasing rewards and benefits. In other words, the more the number of $FLD users who lock-in and the longer the lock-up period, the greater their level, rewards, and benefits.

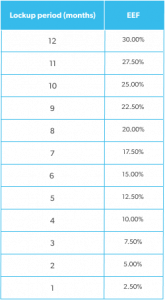

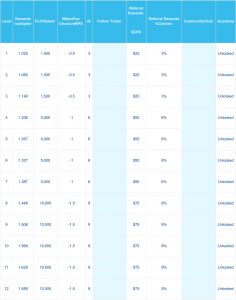

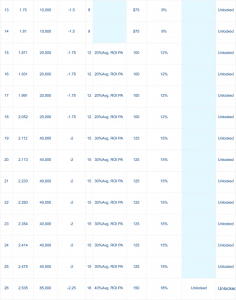

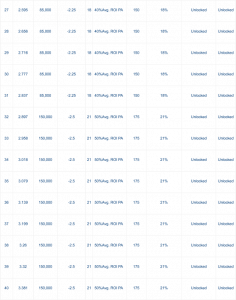

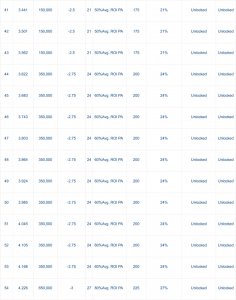

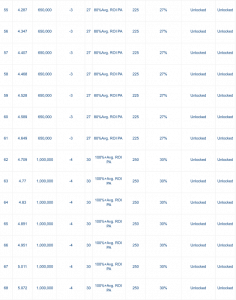

The following table explains the relation between levels, the $FLD lock-up amount, and the lock-up period:

Table: $FLD lock-ups & user level matrix

There are two verticals contributing to level growth:

- The amount staked

- The staking period

There are 100 levels in total that a user can unlock when they stake. As users unlock higher levels:

- They realize a higher amount of APR%

- They unlock access to premium features

Detailed Overview of Level-Based Benefits

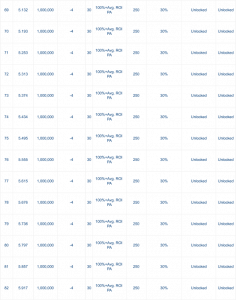

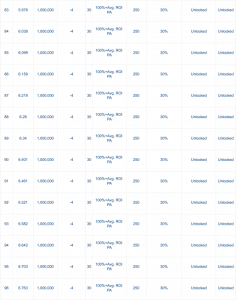

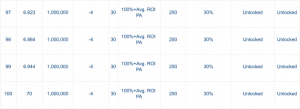

Please refer to the table below for a more detailed explanation of how our ecosystem benefits are scaled based on user levels:

Each staker will be entitled to participate in the $FLD Rewards distribution.

$FLD Rewards Distribution

15% of the entire $FLD token supply will be allocated to FluidAI Rewards, which will be distributed to all stakers within a period of approximately 5 years. $FLD staking rewards will be subject to a logarithmic distribution curve (i.e. the amount of rewards sent to stakers will gradually decrease over time but will never go to zero).

Rewards will be distributed biweekly and is planned to begin at 2,000,000 $FLD tokens with a biweekly decrease rate of 0.49%. Users will be able to claim all received rewards anytime.

At the end of the expected rewards release timeline, FluidAI will decide on the new rewards curve structure and specify the next incentive plan (i.e. by allocating a new budget for the rewards or letting the curve continue its descent).

The logarithmic distribution curve provides an inherent self-balancing of a user’s APR level. In the event the levels go too low, some users may not be interested in renewing their commitment to lock up, which will result in a decrease in stakers, and subsequently, the increase of APR to the optimal level.

Assuming the $FLD logarithmic rewards distribution will sustain for an infinite period of time without budget adjustments, the distribution curve would look as follows:

It’s important to note that the distribution process is proportional to a user’s lock-up weight and rewards multiplier, (the latter being one of the benefits associated with level progression).

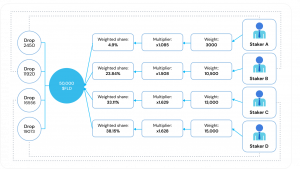

Weighted Rewards Distribution

Users participate in the distribution of rewards based on their lock-up weights and level-based rewards multipliers.

Lock-up weight is calculated by multiplying the locked amount of tokens and lock-up time in months. For example, a user locking 1500 $FLD tokens for 10 months would have a lock-up weight of 15 000 (1500 x 10) while a user locking in 10 000 $FLD for 1 month would have a staking weight of 10 000 (10 000 x1).

The weighted $FLD rewards distribution is calculated by dividing a staker’s weighted score by the total weighted score accumulated by all entitled stakers. This staker’s percentage is then converted to their share of the %FLD to be distributed for that week. For example, if an individual’s score out of 10 stakers was 10%, and the total $FLD to be distributed was 100, then he/she would get 10 $FLD, or 10% of the 100 $FLD to be distributed.

A staker’s weighted score and % of $FLD to be distributed are calculated by:

- Tokens staked

- Lock up period (12 months max)

- Level achieved

- Reward multiplier based on level

The above solution can be expressed using the following equation:

Q =Lw * E[n]Lt

Where:

Q = is the amount of rewards received by a single user

Lw = is the lock-up weight of a single user multiplied by his/her level-based rewards multiplier

E = is the total distribution amount in a given epoch [n]

Lt = is the sum-product of users’ lock-up weights and their level-based rewards multipliers

Example:

Let’s take 4 users with levels 2, 9, 11 and 12, where their lockup weights are 3,000, 10,500, 13,500, and 15,000 respectively, and their rewards multipliers are 1.085, 1.508, 1.629 and 1.689. If they participate in a weighted rewards distribution of 50,000 $FLD, the split of rewards between them would be as follows:

- User A (lvl 2) split = [50,000 / (3,000 x 1.085 + 10 500 x 1.508 + 13,500 x 1.629 + 15,000 x 1.689)] * (3,000 * 1.085)

- User B (lvl 9) split = [50,000 / (3,000 x 1.085 + 10 500 x 1.508 + 13,500 x 1.629 + 15,000 x 1.689)] * (10,500 * 1.508)

- User C (lvl 11) split = [50,000 / (3,000 x 1.085 + 10,500 x 1.508 + 13,500 x 1.629 + 15,000 x 1.689)] * (13,500 * 1.629)

- User D (lvl 12) split = [50 000 / (3,000 x 1.085 + 10,500 x 1.508 + 13,500 x 1.629 + 15,000 x 1.689)] * (15,000 * 1.689)

Accordingly, users would receive the following rewards:

- User A (lvl 2) = 2,450 $FLD

- User B (lvl 9) = 11,920 $FLD

- User C (lvl 11) = 16,555 $FLD

- User D (lvl 12) = 19,073 $FLD

The above distribution mechanics can be visualized as depicted below:

Please note that the rewards distribution might be altered by our dedicated mechanics protecting our budget from over-incentivizing ecosystem participants.

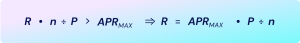

Avoiding Over Incentivization

In order to avoid the distribution of extremely high rewards to a small number of stakers, our rewards distribution system has additional security measures designed to prevent such instances from occurring (i.e. if there is a single staker staking the minimum amount of 1,500 $FLD, then that staker would be entitled to receive the entire amount of $FLD to be distributed, even if that amounted to 2 million $FLD, unless proper preventive mechanisms are in place).

Over incentivization is prevented by introducing a maximum APR limit a user cannot surpass. How to determine if the global max APR level has been surpassed or not:

- Amount of tokens to be distributed is compared against the locked $FLD amount by a staker

- Initial APR is calculated, assuming that the same amount of rewards will be distributed 52 more times (assuming weekly distribution rate).

If the initial APR calculated using the above method is higher than the adopted max APR, the amount of distributed tokens will be lesser and in line using the max APR threshold.

Mathematically, this equation can be expressed as follows:

Where:

R = the amount of rewards to be distributed

n = total amount of distribution in a particular period of time in a year (104 times in a year for twice per week, and 52 times in a year for weekly distribution)

P = total amount of $FLD tokens locked by the user

Max APR limit is one of the gamified bonuses users can unlock along with their level progression. There are 5 consecutive max APR tiers: 100%, 200%, 300%, 400% and 500%.

For example, let’s consider the following scenario of $FLD stakers:

- User A is at level 25 and locks 40,000 $FLD

- User B is at level 1 and locks 1,500 $FLD

If the amount of $FLD tokens to be distributed is 10,000, their rewards will be calculated as follows:

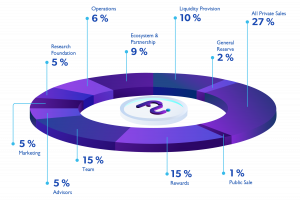

TOKENOMY

FluidAI’s token allocations and vesting schedules have been designed to balance the interests of the various ecosystem participants carefully.

Tokens are sold to strategic partners to fund a solid runway for the company without selling too large of a share so as to allow for a larger reserve during contingencies.

This goal is further supported by applying longer vesting schedules to all sales (including the public round), and only the public round being granted a limited 10% release of its allocation at TGE. This structure ensures that FluidAI only receives capital from strategic partners that are willing to go the distance to work and support the project.

The chosen vesting schedules also commit FluidAI’s team to a long-term vision. Allocations funding internal departmental budgets have been given vesting terms that last 4 to 5 years.

TOKEN DISTRIBUTION:

| Totals | Token Price | |

|---|---|---|

| Total Supply | 2,700,000,000 | |

| FLD Hard Cap | $10,000,000 | |

| Angel Sale | $224,000 | $0.0026 |

| Pre-seed Sale | $1,000,000 | $0.0070 |

| Seed Sale | $2,300,000 | $0.0090 |

| Private Sale 1: | $3,300,000 | $0.0192 |

| Private Sale 2: | $2,176,000 | $0.0250 |

| Public Sale | $1,000,000 | $0.0325 |

| Initial Market Cap | $100,000 | |

| Initial Circulation Supply | 3,077,000 FLD | |

| Fully Diluted Market Cap | $87,750,000 | |

TOKEN EMISSIONS:

TOKEN ALLOCATION:

TOKEN VESTING SCHEDULE:

| Allocation | Vesting Schedule | Monthly Vesting |

|---|---|---|

| Angel (3.2%) | Vests daily over 48 months, beginning day 361 after listing | 2.0% |

| Pre-seed (5.3%) | Vests daily over 18 months, beginning day 91 after listing | 5.5% |

| Seed (9.5%) | Vests daily over 18 months, beginning day 61 after listing | 5.5% |

| Private 1 (6.4%) | Vests daily over 18 months, beginning day 31 after listing | 5.5% |

| Private 2 (3.2%) | Vests daily over 16 months, beginning day 31 after listing | 6.0% |

| Public (1.1%) | 10% unlocked at listing. 90% vests daily over 6 months beginning day 1 after listing | 15.0% |

| Rewards (15%) | Emissions dependent on staking APYs and community uptake | |

| Team (15%) | Vests daily over 48 months, beginning day 181 after listing | 2.0% |

| Advisors (5%) | Vests daily over 36 months, beginning day 181 after listing | 3.0% |

| Marketing (5%) | Vests daily over 60 months, beginning day 31 after listing | 1.6% |

| Research foundation (5%) | Vests daily over 60 months, beginning day 181 after listing | 1.6% |

| Operations (6%) | Vests daily over 24 months, beginning day 1 after listing | 4.0% |

| Ecosystem & Partnerships (9%) | Vests daily over 60 months, beginning day 31 after listing | 1.6% |

| Liquidity provision (10%) | 25% unlocked at listing, 75% vests daily over 35 months beginning day 1 after listing | 2.0% |

| General reserve (1.6%) | Vests daily over 60 months, beginning day 181 after listing | 1.6% |

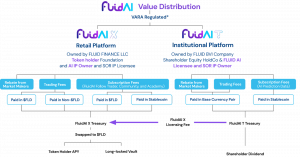

Stakeholder Value Proposition

FluidAI’s business plan has a clear separation of value for token holders and equity holders:

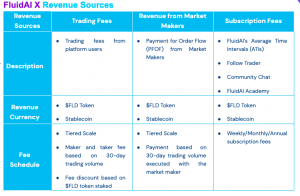

FluidAI X Revenue Sources

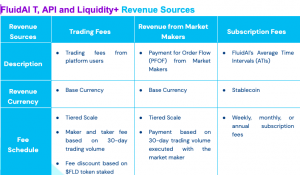

FluidAI T, API and Liquidity+ Revenue Sources

Split of Intellectual Property

The rights to intellectual property are clearly split equally and equitably between token holders of the project and shareholders of the company with aligned incentives and rights.

AI Model Intellectual Property

The AI model’s intellectual property rights are held under the Token Company and are licensed directly to the Holding Company. The prediction data produced by the AI model is licensed to the Holding Company.

A daily license fee is paid by the HoldCo to the Token Company and is calculated on the basis of profitability and performance-based KPIs.

Core Software Development Intellectual Property

The intellectual property rights behind the code that powers the SOR are owned directly by the HoldCo and are licensed directly to the Token Company.

Team

Kiran Pingali, CFA Chief Executive Officer Kiran has 20+ years of experience in electronic trading and product management for fintechs. Worked in equities, quantitative research, trading analytics, and liquidity solutions at the likes of Citigroup, Lehman Brothers, Refinitiv, and Bloomberg. |

Wojciech Głowacz Head of Operations Over 11 years of experience in tier-one TradFi and crypto companies such as Goldman Sachs, PAID Network, and AllianceBlock. Wojciech specializes in financial research, investor relations, project management, tokenomics, fundamental analysis, and risk management. |

Lawrence Henesey Head of Data Science Dr. Henesey leads FluidAI’s application of AI and brings 30 years of experience in the field of various AI technologies such as Multi Agents, Machine Learning, Neural Networks and Genetic Algorithms. Dr. Lawrence Henesey is also an Assistant Professor at the School of Computing (COM), a department located in Blekinge Institute of Technology, which has been ranked #6 in the world for Software Engineering.

|

SECURITY CONSIDERATIONS

FluidAI’s interconnected liquidity ecosystem has been designed to comply with institutional-grade cybersecurity measures. Recent history shows the disrupting and fragile nature of blockchain-based ecosystems can potentially be compromised. In 2021, almost $14 billion worth of cryptocurrencies was lost or stolen as a direct result of a cyber-attack or security breach. Therefore, at FluidAI, we understand the significance of cybersecurity and data privacy and we are dedicated to delivering users and integrated platforms highly secured, privacy-first, frictionless, and a low-latency infrastructure. Cybersecurity, and data privacy controls and requirements have been the core of our infrastructure from the very first day of the product development cycle.

FluidAI’s team includes cybersecurity veterans, innovators, and thought leaders from the most successful traditional finance companies. The team has spent more than two decades securing extremely high-profile organizations ranging from banks, governments, defense, critical infrastructure to crypto firms, protecting them against cyber-attacks, organized cyber-criminals, and advanced threat actors. The FluidAI team is leveraging professional experience to build a safe, secure, trusted, fair, and transparent infrastructure that will meet the institutional-grade actor’s requirements to adopt and leverage blockchain technology.

Cybersecurity Features

FluidAI has been designed from the ground up, and our mission is to build global institutional liquidity with institutional-grade controls.

Some of the key features of our ecosystem:

- Zero Trust Security Architecture (ZTA) Secure and Privacy by Design (SPD)

- Permission-Based Connectivity and Access Controls Advanced Certificate mTLS Authentication Mechanisms Source IP Addressing Filtering and NGFW

- Risk-Based Authentication and Conditional Access Multi-Factor Authentication

- Geolocation IP Address Device Fingerprint

- Leaked / Stolen Credential Anomaly Detection OWASP Top 10 Protection for Web and API

- Web Application Firewalls and API Security Gateways TLS v1.3 Encryption and 4098-bit Encryption Key Length

- Private Key Management and Hardware Security and Encryption Module MPC Wallet Technology and Multi-Party Approval Process

- Tamperproof Data Protection Controls for Global Liquidity Order Book Data Integrity and Reentrancy Attack Prevention for Order Executions Secure Webhooks for Order Execution Notifications

- Institutional Internal Governance and Controls

- Information Security Policies, Processes and Procedures Cyber Risk Management Practice

- Change Management Controls Role-Based Access Controls

- Segregation of Duties (SoD)

- Secure Development Practice – DevSecOps and SecSDLC Vulnerability and Patch Management

- Penetration Testing and Code Reviews SecOps – Network and Infrastructure Security

AI Governance

When training the data-set for our AI-powered Decentralized Autonomous Organization (DAO), several key AI governance considerations are taken into account to prevent Sybil attacks and biases, particularly to prevent Sybil attacks specifically when it comes to Governance and Voting. Here are some important considerations:

- Proof of Stake (PoS) mechanisms

- Reputation Systems to route malicious actors

- KYC / Identity verification

- Token-Weighted Voting

- AI-Based Anomaly Detection Algorithms to detect anomalous behavior that might indicate Sybil attacks

- Governance Audit

- Discrimination based attacks

By implementing these AI governance considerations, the FluidAI DAO can strengthen its resistance to Sybil attacks and promote a more secure and trustworthy voting system. However, it is important to continuously evaluate and improve the governance mechanisms to adapt to evolving threats and challenges.

REGULATORY LANDSCAPE

While the financial revolution and benefit brought on by the advent of DeFi is well known, FluidAI is thoroughly aware of the compliance challenges immediately facing our nascent industry and the fast-evolving virtual asset regulatory frameworks facing all participants globally.

In putting ourselves forward as a business partner and engaging with both the retail and institutional community and operating in an industry that is fraught with a reputation of harboring bad actors, FluidAI and its full ecosystem – from member exchanges and liquidity takers to users and token holders – strives to adhere to the highest compliance and security standards by constantly reviewing our internal and external policies and procedures.

FluidAI has developed its own policy and is currently submitting all the necessary documentation and requirements to the Dubai-based Virtual Asset Regulatory Authority (“VARA”) in order to ensure compliance from all aspects of our business.

RISKS DISCLAIMER:

The FluidAI platform is currently in the initial development stages and there are a variety of unforeseeable risks. You acknowledge and agree that there are numerous risks associated with acquiring $FLD, holding $FLD, and using $FLD for participation in the FluidAI platform. In the worst scenario, this could lead to the loss of all or part of $FLD held. IF YOU ACQUIRE $FLD OR PARTICIPATE IN THE FluidAI PLATFORM, YOU EXPRESSLY ACKNOWLEDGE, ACCEPT AND ASSUME THE FOLLOWING RISKS:

- Uncertain Regulations and Enforcement Actions: The regulatory status of the FluidAI platform, $FLD and distributed ledger technology is unclear or unsettled in many jurisdictions. The regulation of digital assets has become a primary target of regulation in all major countries in the world. It is impossible to predict how, when or whether regulatory agencies may apply existing regulations or create new regulations with respect to such technology and its applications, including $FLD and/or the FluidAI platform. Regulatory actions could negatively impact $FLD and/or the FluidAI platform in various ways. The Company, the Distributor (or their respective affiliates) may cease operations in a jurisdiction in the event that regulatory actions, or changes to law or regulation, make it illegal to operate in such jurisdiction, or commercially undesirable to obtain the necessary regulatory approval(s) to operate in such jurisdiction.

- Inadequate disclosure of information: As at the date hereof, the FluidAI platform is still under development and its design concepts, consensus mechanisms, algorithms, codes, and other technical details and parameters may be constantly and frequently updated and changed. Although this material contains the most current information relating to the FluidAI platform, it is not absolutely complete and may still be adjusted and updated by the FluidAI Finance team from time to time. The FluidAI Finance team has neither the ability nor obligation to keep holders of $FLD informed of every detail (including development progress and expected milestones) regarding the project to develop the FluidAI platform, hence insufficient information disclosure is inevitable and reasonable.

- Competitors: Various types of decentralised applications, games and networks are emerging at a rapid rate, and the industry is increasingly competitive. It is possible that alternative networks could be established that utilise the same or similar code and protocol underlying FLD and/or the FluidAI platform and attempt to re-create similar facilities. The FluidAI platform may be required to compete with these alternative applications, names, and networks, which could negatively impact FLD and/or the FluidAI platform.

- Failure to develop: There is the risk that the development of the FluidAI platform will not be executed or implemented as planned, for a variety of reasons, including without limitation the event of a decline in the prices of any digital asset, virtual currency or $FLD, unforeseen technical difficulties, and shortage of development funds for activities.

- Security weaknesses: Hackers or other malicious groups or organizations may attempt to interfere with $FLD and/or the FluidAI platform in a variety of ways, including, but not limited to, malware attacks, denial of service attacks, consensus-based attacks, Sybil attacks, smurfing and spoofing. Furthermore, there is a risk that a third party or a member of the Company, the Distributor or their respective affiliates may intentionally or unintentionally introduce weaknesses into the core infrastructure of $FLD and/or the FluidAI platform, which could negatively affect $FLD and/or the FluidAI platform. Further, the future of cryptography and security innovations are highly unpredictable and advances in cryptography, or technical advances (including without limitation development of quantum computing), could present unknown risks to $FLD and/or the FluidAI platform by rendering ineffective the cryptographic consensus mechanism that underpins that blockchain protocol.

- Risks Associated with Markets for $FLD: You should be aware that the markets for cryptocurrencies are subject to extreme volatility. These fluctuations may increase or decrease the value of your assets at any given moment and in some cases, any specific cryptocurrency or digital asset may even become worthless. There is a risk that significant losses will arise to users as a result of volatility and speculation. Users must ensure they take all these risk factors into account when deciding on the amount they wish to purchase and the frequency with which they wish to trade. If you feel uncomfortable with the risks or your financial position then you need to reduce or even eliminate your exposure to buying or trading cryptocurrencies.

Cryptocurrencies are also not normally backed by any governmental body, legal entities or by real assets. This means they may not have any redemption value and their trading is not supervised. Cryptocurrencies are backed by technology and the trust of users in the technology to create suitable trust-less protocols to manage transactional information. There is no central bank or regulator that will take corrective measures in the event of a failure of a cryptocurrency or digital asset or the wider market. In addition, there is no public insurance or asset guarantee scheme that will protect you from any losses including from unauthorized use of your cryptocurrencies and from cybercrime and in addition, it may not be possible or commercially feasible for us to obtain private insurance to seek to mitigate our and your risks from the same.

- Risk of Uninsured Losses: Unlike bank accounts or accounts at some other financial institutions, $FLD are uninsured unless you specifically obtain private insurance to insure them. Thus, in the event of loss or loss of utility value, there is no public insurer, such as the Federal Deposit Insurance Corporation, or private insurance arranged by us, to offer recourse to you.

- Risks Arising from Taxation: The tax characterization of $FLD is uncertain. You must seek your own tax advice in connection with purchasing $FLD, which may result in adverse tax consequences to you, including withholding taxes, income taxes, and tax reporting requirements.

- Risk of Insufficient Interest in the Platform or Distributed Applications: It is possible that the Platform will not be used by a large number of individuals, companies, and other entities or that there will be a limited public interest in the creation and development of distributed platforms (such as the Platform) more generally. Such a lack of use or interest could negatively impact the development of the Platform and the potential utility of $FLD, including its utility.

- Other risks: In addition, the potential risks briefly mentioned above are not exhaustive and there are other risks (as more particularly set out in the Terms and Conditions) associated with your participation in the FluidAI platform, as well as acquisition of, holding and use of $FLD, including those that the Company or the Distributor cannot anticipate. Such risks may further materialize as unanticipated variations or combinations of the aforementioned risks. You should conduct full due diligence on the Company, the Distributor, their respective affiliates, and the FluidAI Finance team, as well as understand the overall framework, mission and vision for the FluidAI platform prior to participating in the same and/or acquiring $FLD. $FLD does not in any way represent any shareholding, participation, right, title, or interest in the Company, the Distributor, their respective affiliates, or any other company, enterprise or undertaking, nor will $FLD entitle token holders to any promise of fees, dividends, revenue, profits or investment returns, and are not intended to constitute securities in any relevant jurisdiction. $FLD may only be utilized on the FluidAI platform, and ownership of $FLD carries no rights, express or implied, other than the right to use $FLD as a means to enable usage of and interaction within the FluidAI platform. The secondary market pricing of $FLD is not dependent on the effort of the FluidAI Finance team, and there is no token functionality or scheme designed to control or manipulate such secondary pricing.

You remain responsible for taking care to understand the technological, economic and legal nature of cryptocurrencies and for carefully managing your exposure in accordance with that understanding and your risk appetite for innovative, volatile, and speculative new technologies and assets.

— END —