Imperial College London and FluidAI Announce Groundbreaking AI Partnership! Read here 🤝

Macro & Crypto Markets Newsletter #2

Macro & Crypto Markets Newsletter #2

Macro Markets Themes

- Economic slowdown abates

- Renewed investor risk appetite as macro risk factors reassessed

- US CPI slows for a third consecutive month

Economic slowdown abates

- Highly negative assessment of future economic growth prospects appear unfounded

- Risk of a global and/or regional recessions in 2023 reassessed to a lower probability

- Sentiment has shifted from ‘hard landing’ (recession) economic scenario to ‘soft-landing’ scenario where economic growth slows sufficiently to continue cooling inflation but does not fall off a cliff

- Return of China to the global economy seen as positive for global trade and global commodity demand, helping to partially offset the slowdown in global growth

- For crypto, this likely means that the macro landscape is less of a headwind (downside risk) over the short term (1-3 months)

Renewed investor risk appetite as macro risk factors reassessed

- Given the above and considering a shift in sentiment from extremely bearish to a more neutral outlook, investors are once again more constructive on risk assets (equities, high-yield credit, commodities, crypto)

- Despite this, professional investors remain (underweight in?) underweight US equities, they remain cautious and are looking to other markets for potentially better returns

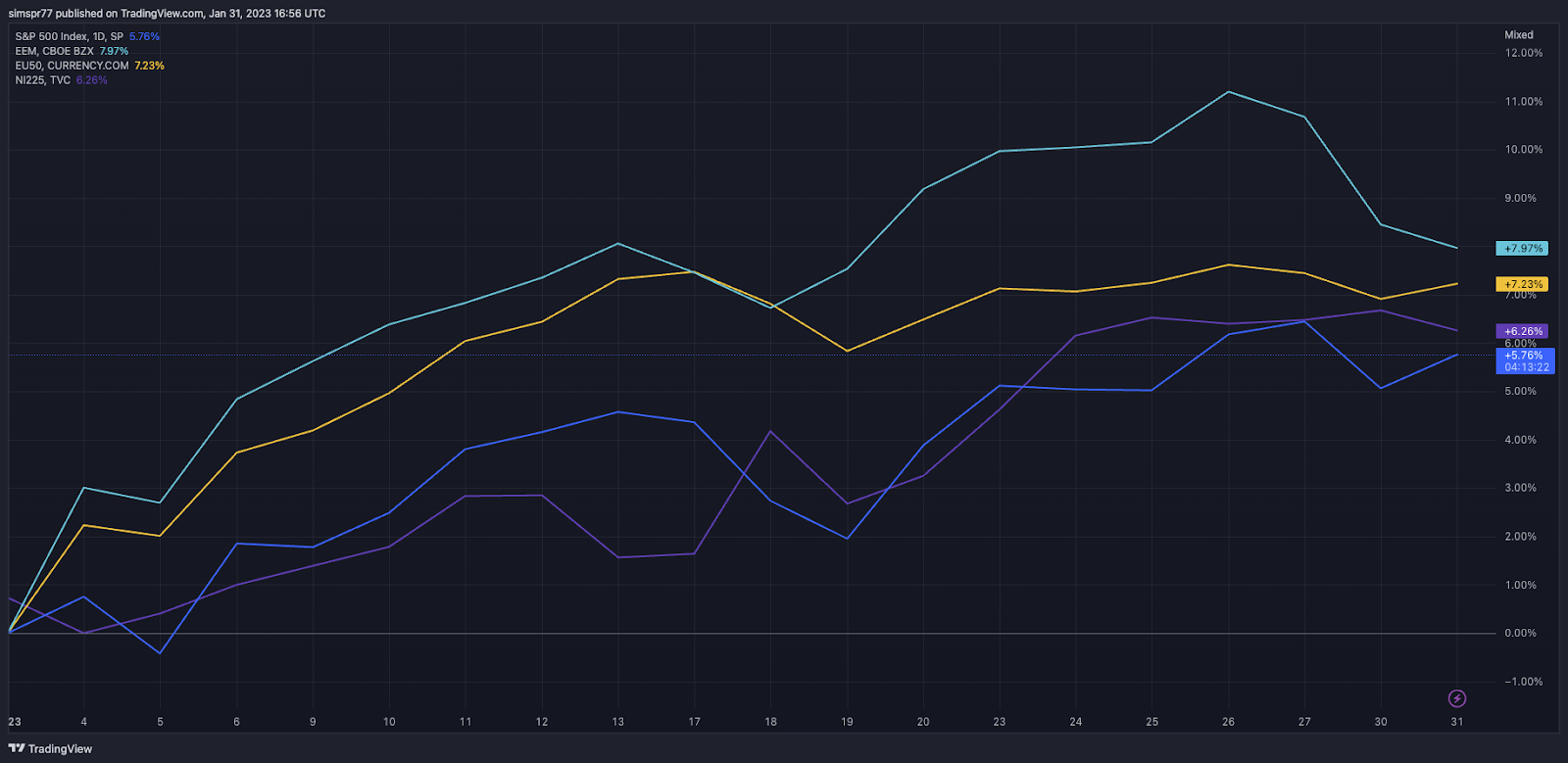

- Other developed and emerging markets are the beneficiaries of this renewed risk appetite, marking one of the strongest starts to the year for non-US equity markets

- A weaker US Dollar and future expectations of further weakness, in the short-to-medium term, along with the Chinese economic reopening, are likely the major driving forces behind the strong returns in non-US equity markets – see chart below

- Improved macro risk appetite is a strong tailwind for crypto markets given the positive correlation between US technology stocks, and equities more broadly, and crypto

Source: Trading View

Blue = S&P500; Purple = Japanese Nikkei 225 Index; Yellow = European 50 Index; Cyan = MSCI EM Index ETF; snapshot taken 31 January at 17:05 GMT

US CPI slows for a third consecutive month

- Headline consumer price inflation declined to 6.5% year-over-year; it is down from 9.1% in June 2022

- A continued slowdown in inflation supports investor expectations that the current interest rate hiking cycle in the US is nearing its end i.e., the worst of the market impacts of higher short-term interest rates is now mostly likely in the rear-view mirror

- Increased expectation of an impending pause by the Federal Reserve, no further interest rate increases, and better-than-expected economic growth data (see above) in the short-term, has aided the shift in risk appetite seen this month

- Market expectation is for the Federal Reserve to raise short-term rates by 0.25% in February, down from December’s 0.5% increase; this downshift in magnitude is a further indication to investors that the end of this interest rate-hike cycle is approaching

- However, there remains the potential for investors to be caught off-guard, a sharp reversal in risk assets, should the Federal Reserve chairman take a very hawkish tone, indicating that interest rates will remain higher for longer, following the February rate announcement

- As risk sentiment evolves across all markets, crypto will likely be a leading indicator of these changes

Crypto Market Themes

- Crypto markets rally strongly in January

- Bear market rally or the beginning of a new market cycle?

- Developer ecosystem grows despite 2022 price declines

Crypto markets rally strongly in January

- 40%+ moves across crypto have caught many by surprise as 2023 is off to a very strong start

- Much of this rebound has been due to short position covering where short sellers have either been liquidated or forced to reduce their positions meaning a removal of broad market sell pressure

- Given the material selling in 2022, it is likely that most investors who wished to sell have done so already, and so crypto markets have reached a point of seller exhaustion, priming markets for a set-up of potentially strong upsideprice action which has now materialized

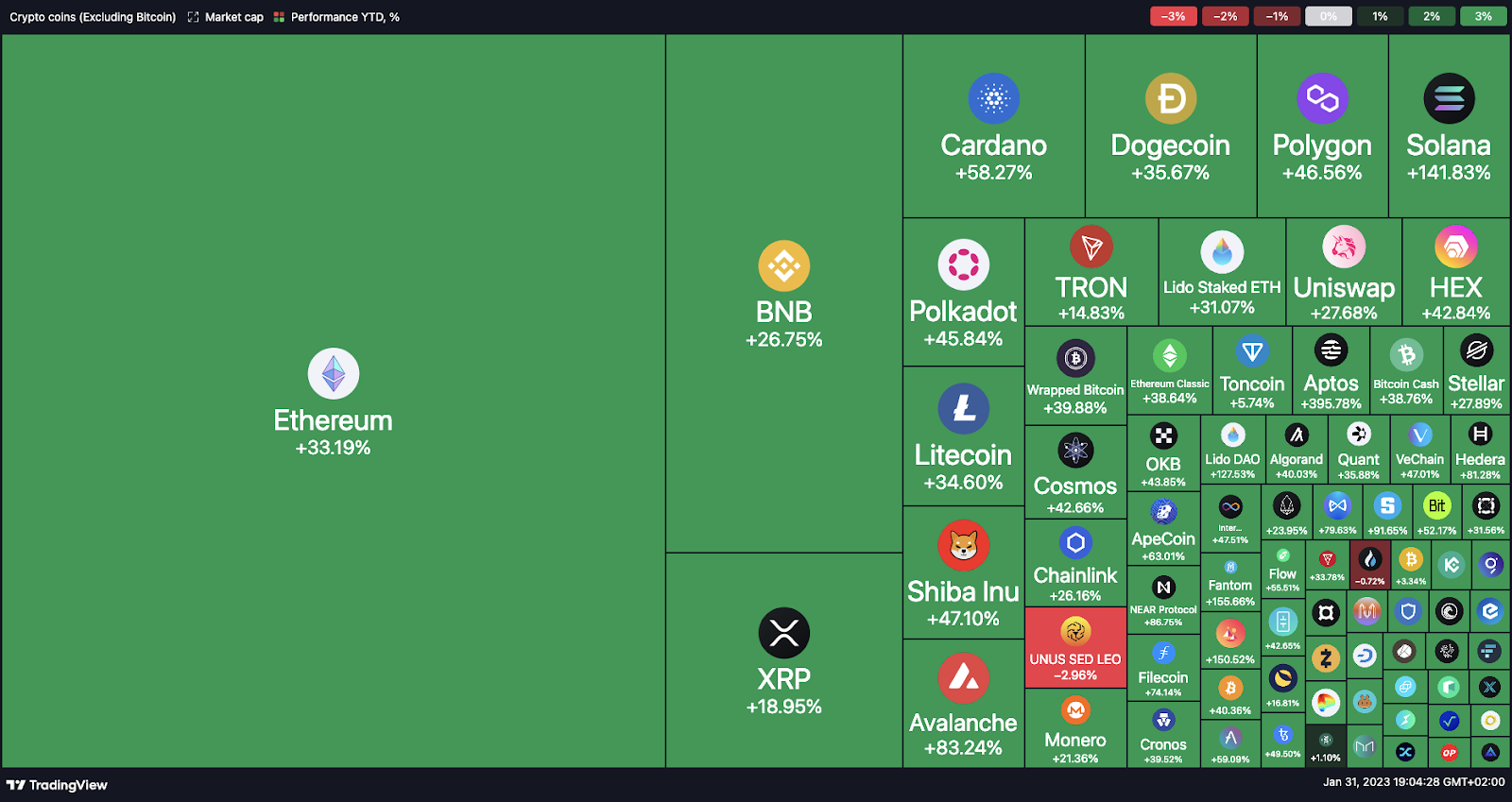

- Bitcoin (BTC) and Ether (ETH) have led this move higher with the broader market following suit – see image below

- Macro factors, discussed above, have turned more supportive in the short-term and crypto has benefitted from this temporary shift

- The sustainability of this rebound remains in question, while the worst may now be behind us, i.e., 2022, crypto markets are not out of the woods yet

Source: Trading View

Heat-map of 1-month market returns; BTC excluded from above; snapshot taken 31 January at 17:05 GMT

Bear market rally or the beginning of a new crypto cycle?

- Both the price of BTC and ETH have likely found a bottom for this part of the crypto market cycle

- Factors which indicate this is the case are:

- Recent persistence of highly negative investor sentiment (see general media articles and social media comments),

- Sellers appear exhausted with little sell pressure remaining

- Likely that most of the leverage built up in the previous bull market has been cleared out

- This current point in the cycle is historically consistent with market bottoms – in the previous two cycles BTC bottomed in December 2018 and January 2015

- Only time will tell whether the bottom is in, however also considering January price action on top of the above factors, it makes a strong case

- Notably, the bankruptcy filing of Genesis has been largely shrugged off by markets, implying much of the FUD present in December concerning Genesis and Digital Currency Group is no longer of material concern, and that potential negative price impact risks here have largely been digested

Developer ecosystem grows despite 2022

- An annual report by Electric Capital provides positive news on the developer front, indicating approximately 23,000 active monthly developers in this space, an annual increase of 5% despite the 2022 bear market

- Developer activity here is measured by the amount and frequency of code commits made to open-source crypto code repositories

- Other notable findings include:

- 72% of developers focus on non-BTC and ETH protocols/projects

- ETH has seen 600% growth in its developer pool over the past 5 years to approximately 5,800 monthly developers

- Over the same period, developers working on Solana, Cosmos, Polkadot and Polygon grew collectively from less than 200 to 1000+ developers

- This report sends a strong signal that crypto prices are not the best barometer of overall crypto ecosystem health, rather what matters more for long-term sustainability of the industry is the growth and development of the underlying technology and related applications being built by developers. These applications will attract more users resulting in greater adoption and usage over time

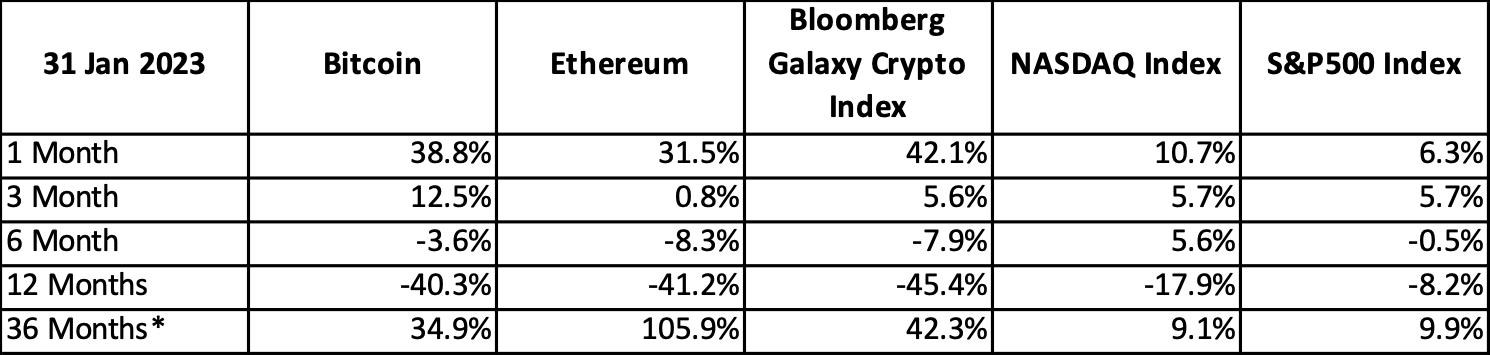

Market Performance

Source: Bloomberg

All returns in USD

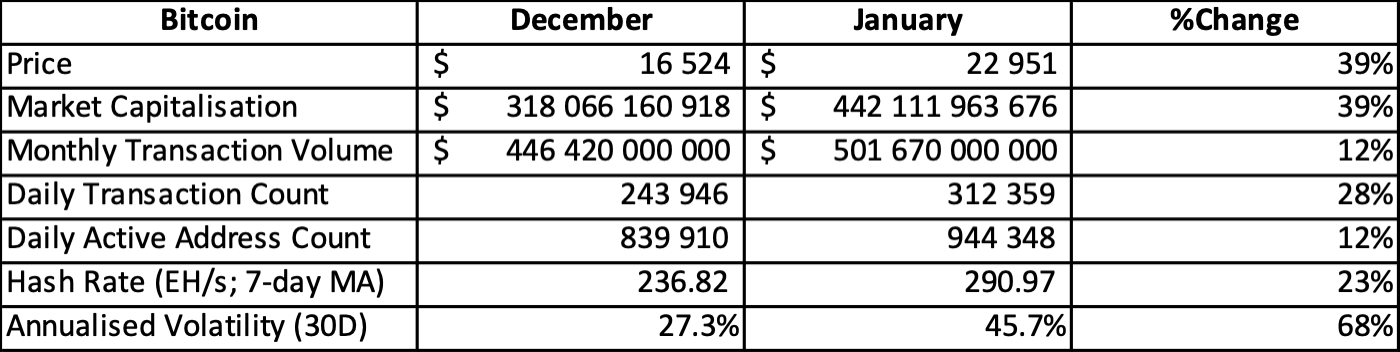

Bitcoin Network Metrics

Source: Coinmetrics & The Block

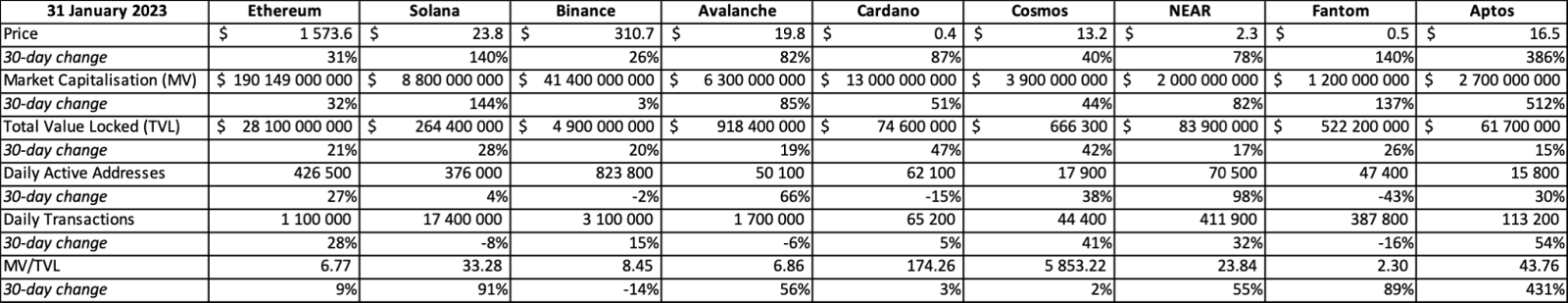

Layer 1 Network Metrics

Source: CoinMarketCap; Artemis

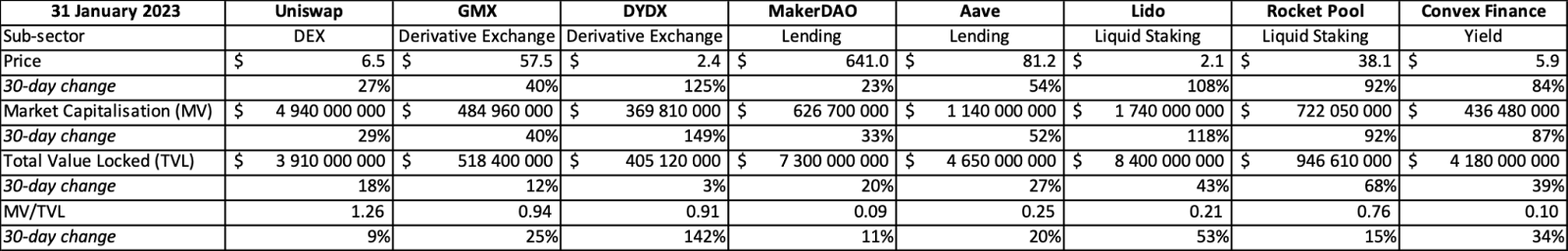

DeFi Network Metrics

Source: CoinMarketCap; Token Terminal

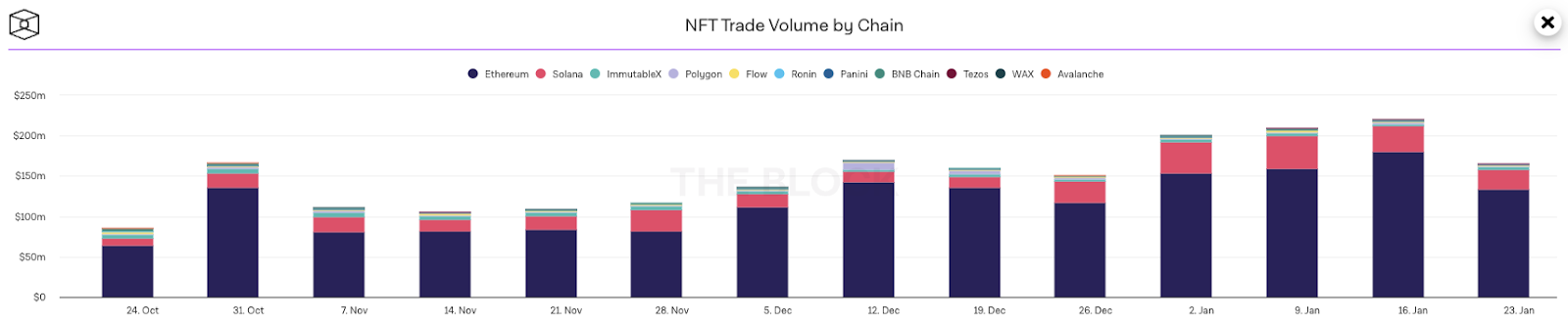

NFT Trading Volumes Per Chain

Source: The Block